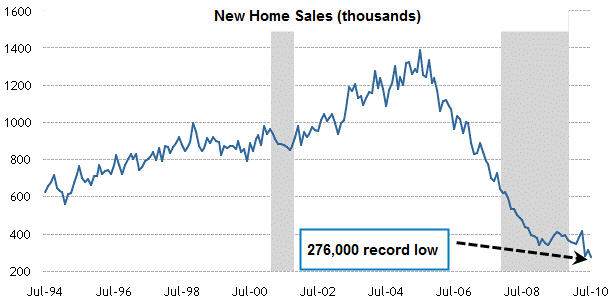

"It all depends on how we look at things." Those words by Carl Jung describe the importance of perspective... which is exactly what last week’s economic reports on home sales require! Existing Home Sales were reported well below expectations and a significant 27% decline from last month. As you can see in the chart below, New Home Sales were also ugly - coming in well below expectations and at the lowest reading on record. But as Carl Jung said, let's take a step back and gain a wider perspective about how we look at those reports... and what they mean!

With all due respect, the actions from the Washington academics are invariably filled with unintended negative consequences. The First Time Homebuyer Tax Credit is a good example. It's now clear that the tax credit has done more harm than good...all at an enormous cost to those who pay taxes. Here’s why: The tax credit simply rewarded those who were already going to purchase homes, as well as those who moved up the timing of an inevitable purchase. But now... the "sugar rush" is over, and the void remains. Worse yet, potential buyers are feeling reticent to make a move after "missing out" on the free money. The obvious problem that remains within our faltering economy is the job market. Yet the focus from Washington has been elsewhere. And it can be argued that each landmark passage of reforms - from aviation to healthcare to financial - has made job creations more challenging.

But eventually we expect some better decisions to come out of Washington. This, along with time, will help the housing market and overall economy recover - making for a good long-term buying opportunity in today's market. Remember, the best investors buy during the most pessimistic times.

To highlight this - as well as give us better perspective and some hope towards the future - here’s something that was recently pointed out by Dennis Gartman, a well-respected market analyst. Back in 1992, an article in Time Magazine included this passage:

"The US economy remains almost comatose. The slump already ranks as the longest period of sustained weakness since the Depression. The economy is staggering under many ‘structural’ burdens, as opposed to familiar ‘cyclical’ problems. The structural faults represent once-in-a-lifetime dislocations that will take years to work out. Among them: the job drought, the debt hangover, the banking collapse, the real estate depression, the health care cost explosion and the runaway federal deficit."

It's amazing how eerily similar the picture from 1992 compares to today. We all know that the period following 1992 included terrific growth and opportunities in the economy, stock market and housing. If history repeats itself, which it often does, this could point to much better days in the future with opportunities in the present.

-----------------------

New Home Sales Hit a Record Low in July 2010

Speaking of revisiting the past... back in 1985, the Kansas City Royals faced the St. Louis Cardinals in the World Series. This was known as the "I-70 Showdown" World Series, as I-70 is the route that connects both cities, and the road along which fans traveled between both stadiums. Lately, there's been another I-70 Showdown, between Kansas City Fed President Thomas Hoenig and St. Louis Fed President James Bullard. And interestingly enough, both Fed Presidents spoke at the ongoing Jackson Hole Symposium, which was hosted last week by the Kansas City Fed. Hoenig kicked off things with his opening speech Thursday night. While he has clearly been the most vocal Fed inflation hawk - calling for an increase in the Fed Funds Rate to at least 1% ASAP to prevent future inflation - his opening remarks were mellow.

The next morning, it was St. Louis Fed President Bullard's turn at the plate. While Bullard has been quite the inflation dove of late - calling for the Fed to do more to prevent deflation - his remarks were rather surprising. He stated that he doesn't see a double dip recession, despite the economy being a bit softer. He further commented that he expects reasonable growth during the second half of this year and for the economy to be back on track during 2011. Those are pretty positive comments from a man who actually went right from stage to an appearance on CNBC, where he went on to state his most surprising comment, which was that the Fed has done as much as they will do for the Mortgage Backed Securities (MBS) market.

The main event came when Fed Chair Ben Bernanke was up. In his comments Friday morning, he appeared to dismiss the deflation scenario, stating it wasn't much of a risk as the Fed has the tools to combat deflation. Those tools include more purchases of longer-term securities - and when you take this comment along with what Bullard said previously about MBS, it looks like the Fed may lean their purchases towards longer term Treasuries. This incestuous relationship between the Fed and the Treasury gives the US a license to print money at low rates, which will almost certainly end with an inflation problem down the road.

Another tool would be lowering the interest paid on excess reserves, which may influence banks to lend out that money; however, much like pushing on a string, this has been difficult to do.

A final tool would be signaling that the Fed will keep short-term interest rates close to zero for longer than what the market currently expects, or for an "extended period." Some are looking for the Fed to give clarity as to when they'll look to raise rates, such as an unemployment rate that dips to "x" level. But the Fed does not appear to want to be handcuffed to such a trigger, as economic circumstances contain so many moving parts.

LOOKING FORWARD TO THIS COMING WEEKEND, THE LABOR DAY HOLIDAY IS ALREADY UPON US. THAT MEANS SUMMER IS QUICKLY COMING TO AN END, BUT THERE’S STILL TIME TO TAKE A WELL-DESERVED, LAST-MINUTE VACATION. CHECK OUT THE MORTGAGE MARKET GUIDE VIEW BELOW FOR TRAVEL TIPS THAT CAN HELP YOU GET AWAY YET THIS SUMMER.