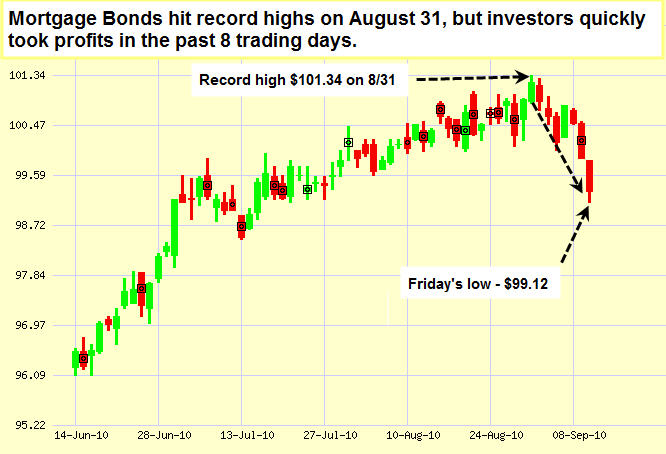

Below is the criteria that a current homeowner must be able to meet to be able to qualify for The New Short Refinance program through FHA. This is a new program that HUD rolled out earlier this month to help homeowners who are under water to refinance their mortgages, and even get some principal reduction up to 10% of their first mortgage.

BUT here’s the realty. As you can see by the requirements below, it ‘s most likely that very few people will be able to qualify for this program. If they can, or would like to find if they can, they would call the current servicer of their mortgage and start the approval process with them.

This is a topic that a lot of homeowner’s are going to hearing about, and are naturally going to want to participate in. So you will need to have the knowledge and information to advise them when they ask.

1. The homeowner must be in a negative equity position;

2. The homeowner must be current on the existing mortgage to be refinanced;

3. The homeowner must occupy the subject property (1-4 units) as their primary residence;

4. The homeowner must qualify for the new loan under standard FHA underwriting requirements and possess a “FICO based” decision credit score greater than or equal to 500;

5. The existing loan to be refinanced must not be a FHA-insured loan;

6. The existing first lien holder must write off at least 10 percent of the unpaid principal

balance;

7. The refinanced FHA-insured first mortgage must have a loan-to-value ratio of no more than 97.75 percent;

8. Non-extinguished existing subordinate mortgages must be re-subordinated and the new loan may not have a combined loan-to-value ratio greater than 115 परसेंट

In This Issue

In This Issue