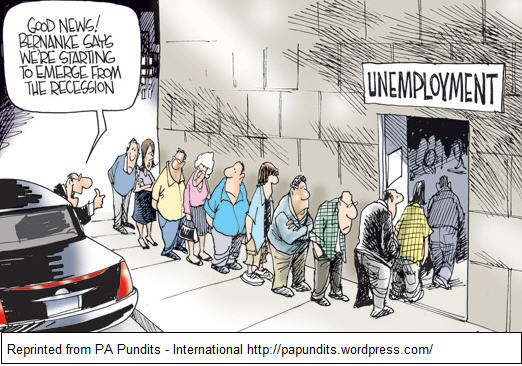

"EVERYBODY’S WORKING FOR THE WEEKEND...." (Loverboy, 1981) Or... are they? Unfortunately, many folks out there these days sure wish they were working at all... and the Labor Department reported last Friday that the US lost 95,000 jobs in September. What else did the Jobs Report say and what could the news mean for home loan rates? Read on for details.

A closer look at the Jobs Report for September shows that 159,000 of the jobs lost were government workers, many of which are the unwinding of the temporary census hires. The more important private sector added 64,000 jobs - but still not great, and also below the 74,000 expected. But this number confirms the thought that the economy, or the Job market, is stabilizing and perhaps even improving, albeit it at a very gradual pace. More on why this is so important in a minute.

The Jobs Report also showed that the Unemployment Rate remained at 9.6%, just below the 9.7% anticipated. However, it’s likely the actual rate of unemployment is higher. Why? Because if an unemployed individual does not seek employment for four weeks, they are removed from the count of the "officially unemployed." And with unemployment benefits available for about 2 years, it increases an unemployed individual's chances of becoming less motivated to look for a job, until the benefits are close to running out.

The Jobs Report also showed that the Unemployment Rate remained at 9.6%, just below the 9.7% anticipated. However, it’s likely the actual rate of unemployment is higher. Why? Because if an unemployed individual does not seek employment for four weeks, they are removed from the count of the "officially unemployed." And with unemployment benefits available for about 2 years, it increases an unemployed individual's chances of becoming less motivated to look for a job, until the benefits are close to running out.

This can skew the headline Unemployment Rate, and is evidenced by the sharp rise in the overall unemployment rate or "U6" measurement of unemployment, which stands at 17.1%. The U6 rate accounts for these discouraged workers who have not sought employment for the past four weeks, as well as those who have accepted part-time employment but would prefer to be working full-time.

Now, back to the question of why signs of good - or bad - economic news are particularly important of late. The Fed will be watching the various economic reports very closely over the next few weeks in advance of their next regularly scheduled meeting on November 2-3, as they are considering a second round of Quantitative Easing (QE2) to ensure that our slowing economy does not slow even further. If the economic reports that are ahead are more negative than positive, this will increase the likelihood of more QE... but it’s not a foregone conclusion at this point in the least.

So what does all this have to do with home loan rates? If the economic news continues to be soft and the Fed does go through with another round of QE, Bond prices and home loan rates may initially improve for two reasons. First, if the economic data is weak leading up to an announcement - that soft economic news tends to be bad for Stocks, but good for Bonds and therefore home loan rates. Additionally, Bonds would improve simply because the announcement of QE would include large Bond purchases. But keep in mind that the key word is "initially." Even though Bonds and home loan rates could initially improve, the eventual softening of the Dollar, rising commodity prices, and rise in Stock prices would become a drag on Bonds, which would negatively impact home loan rates.

We’ll see what happens in the coming weeks leading up to the Fed’s next meeting on November 2-3. But last week, meanwhile, the news had a positive impact on Bonds and home loan rates, as they ended the week about .125 to .25 percent better than where they began.

If you or anyone you know would like to learn more about taking advantage of historically low home loan rates, please don’t hesitate to call or email me as soon as possible. Or forward this newsletter on to anyone you think may benefit and I’d be happy to talk to them free of charge.

FINDING IT HARD NOT TO TEXT AND DRIVE? YOU CAN DO IT SAFELY…THANKS TO THIS GREAT NEW APP. CHECK OUT THE MORTGAGE MARKET GUIDE VIEW FOR DETAILS.

No comments:

Post a Comment